Update: As of April 15th, the IRS has launched its official tool to track the status of COVID-19 stimulus payments.

After the US government passed the landmark $2 trillion stimulus bill, the American public was overjoyed to hear that most taxpayers would receive direct payments of $1,200 – and some would receive more depending on their family size.

This huge economic relief bill, officially called the 2020 Stimulus CARES Act, will send more than $290 billion in direct payments to both individuals and families across the United States. The goal is to help bolster the economy by keeping people afloat and injecting much-needed cash into the marketplace.

Politicians have been working on this plan for several weeks and according to the Secretary of the Treasury, Steve Mnuchin, they are planning on having checks in Americans’ hands within a number of weeks.

According to the bill, most adult Americans will receive a $1,200 check with an additional $500 per dependent child (up to 16 years old.)

They will identify your familial status and income information based on your 2019 or 2018 tax return – whichever has been most recently filed.

Individuals who made $75,000 or less on their most recently filed tax return can expect to receive the full $1,200 check. Those who made more than that will see the amount reduced by $5 per $100 in income on a sliding scale. That means that any individual who made more than $99,000 will not receive a check.

Example: An individual with no dependents, who made $85,000, would only receive a $700 check.

The scale is similar for married couples filing jointly, but they are set to receive a check for $2,400.The limit is $150,000 in income, with payments depleting at the $198,000 mark for a couple with no dependents.

Example: A married couple with no dependents, who made $165,000, would only receive a $1,650 check.

If you are a family of four, who makes less than $150,000 per year with both children under the age of 16 – you can expect to receive a $3,400 check.

To find out what your total “Adjusted Gross Income” was for your most recent tax filing look on Form 1040. For 2018 taxes, it will be shown on Line 7, for 2019 it will appear on Line 8b.

Now that you know how to estimate what your economic stimulus payment would be – the next question is When Will I Get The Payment?

3 New IRS Economic Stimulus Tools

Luckily enough, the IRS is already a step ahead and has prepped several tools to be released this week in order to help people track their stimulus checks and get them faster.

For people who are not required to file taxes or made less than $12,200/person:

The first tool will allow folks who traditionally are not required to file taxes to submit their basic tax status information and payment details to the IRS directly. This group of people is called “Non-Filers” by the IRS and includes people who were not required to file in 2018 or 2019 or who made less than $12,200 (for individuals, $24,400 for married).

You can find the tool for Non-Filers on the official IRS website.

How to update your payment information or direct deposit details:

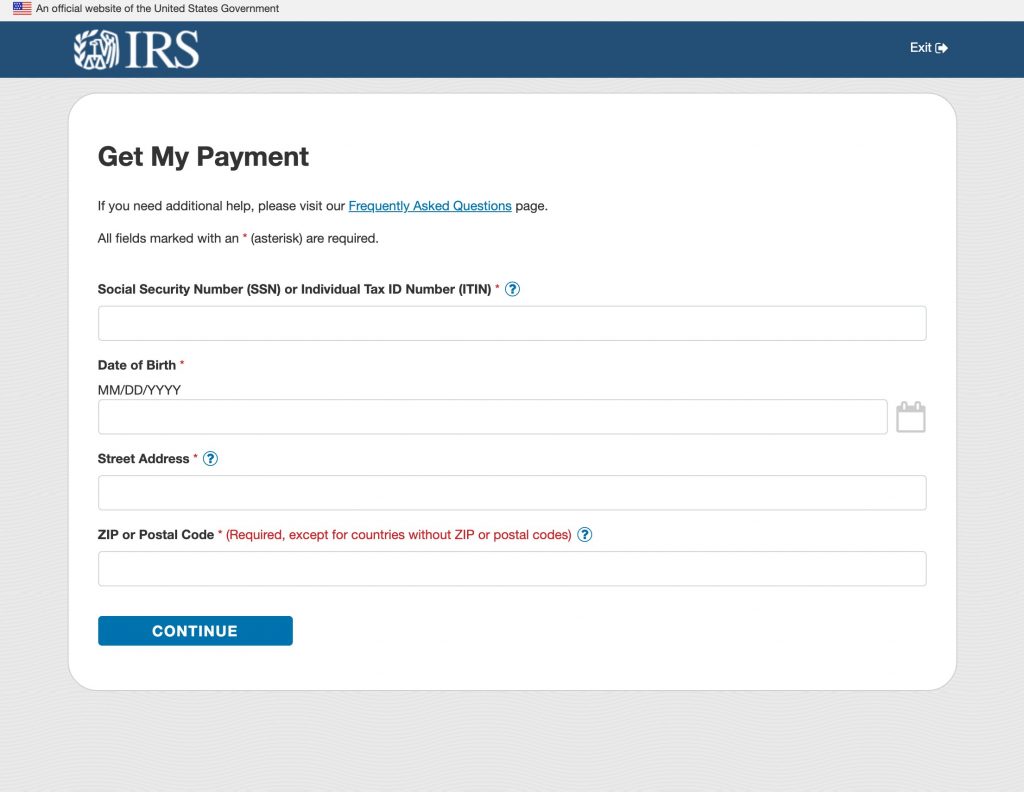

The second tool that the IRS will be releasing is to allow people to update their direct deposit information with a tool called “Get My Payment.”

The Get My Payment tool is there to provide anyone the opportunity to change or update their payment preferences. This is helpful for those who did not provide direct deposit information to the IRS on their 2018 / 2019 tax returns or who may have changed their information and need to update it.

The IRS’ Get My Payment tool is NOW AVAILABLE and can be found on the official IRS website.

How to track your Economic Impact Payment:

The IRS has stated that the first payments for people who have direct deposit already set up with the IRS will go out this week. There has been no word on how long it will take to get a check payment.

Along with the ability to update / add your direct deposit information using the Get My Payment tool, the IRS has said that the tool will also show you the status of your payment. This information will include the date your payment is scheduled to be deposited or the date a paper check is set to be mailed out to your address.

Again, this tool is NOW AVAILABLE – visit the IRS official website for more information on the Get My Payment tool.

Check out the full news report below regarding the first payments being sent.

*** Remember to never enter your personal information on any site other than the official IRS.gov website – always check the web address to make sure you are visiting the correct site ***